Real Estate Tax Planning and Real Estate Dispute Resolution

Investing in U.S. real estate? Investing in real estate can be one of the biggest investments a person or entity makes. We can help you prevent and resolve real estate disputes and answer your tax law questions related to real estate. Real estate brokers are not authorized to practice law and disputes arise when people believe that they are being advised by their brokers about the legal consequences or implications of a real estate addendum or contract when their brokers are not authorized to give an opinion or advice on the legal effect of a contract. Before you sign that provision drafted by the Seller/Buyer/Broker, it would be best to consult with an attorney who can guide you through the consequences or implications of that provision or contract. The consequences of not being well-advised can be financially devastating.

Practice Areas

Contact Us Now

Why Do You Need a Tax Attorney and What Makes The Tax CounselTM Unique?

- A tax attorney gives you the benefit of attorney-client privilege whereas an accountant can only offer attorney-client privilege if acting at the direction of a lawyer to give client information regarding the case.

- A tax attorney specializes in resolving legal concerns regarding tax planning while a CPA or accountant may focus more on managing finances and filing tax returns.

- A tax attorney is trained to defend you in legal actions if the IRS files a lawsuit against you, starts a tax fraud or criminal investigation against you, and can be your legal advocate if you want to file a lawsuit against the IRS.

- At The Tax Counsel,TM we also help you to discover the tax implications of your choice of business entity and can help you review your contracts for legal as well as tax implications.

- At The Tax Counsel,TM approximately 70 to 80% of our business comes from referrals from CPAs and other lawyers. We work hand-in-hand with accountants, CPAs, and other lawyers to serve the best interests of our clients.

- Not every tax attorney specializes in defending clients against the IRS and California Franchise Tax Board. At The Tax Counsel,TM that's our focus.

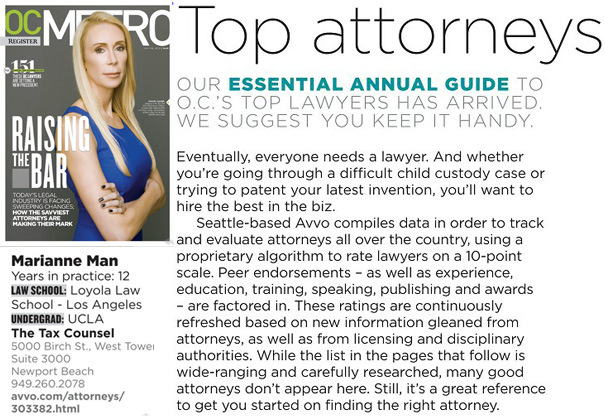

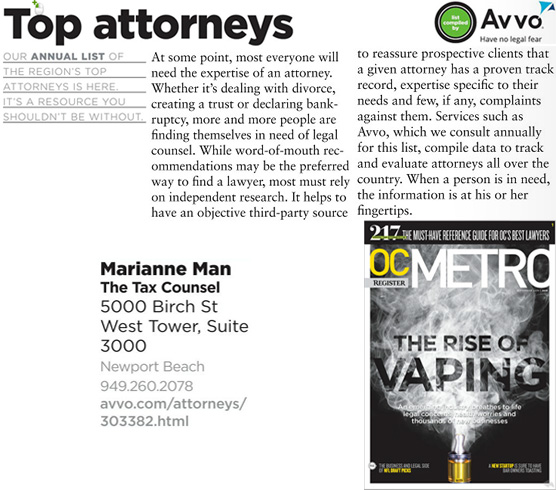

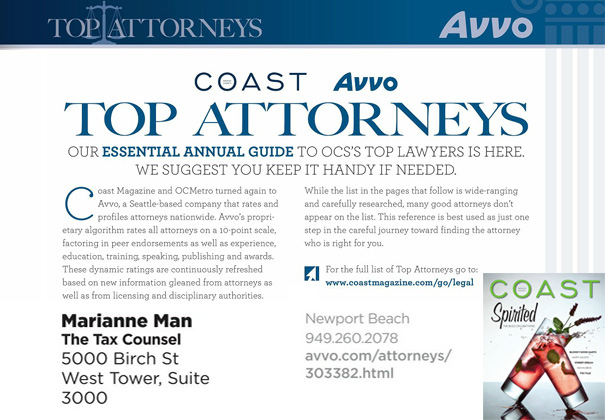

- Mrs. Dawson-Man is a tax lawyer with over 15 years of unique well-rounded legal experience. Please see more about her experience below and CLICK HERE to read the testimonials.

- At The Tax Counsel,TM because we see the triggers that start IRS audits nearly every day, we are in a unique position to help you plan to avoid those triggers.

- At The Tax Counsel,TM we can help you analyze your investments in acquisition of businesses and in the sale of your business from a tax law perspective. Mrs. Dawson-Man was named a top attorney in Mergers & Acquisitions by Los Angeles magazine in its Super Lawyers edition. Getting into a partnership is akin to getting married in many respects. One would be wise to have the transaction analyzed from a tax law perspective from an attorney who is experienced in defending IRS tax audits BEFORE one invests in a business partnership.